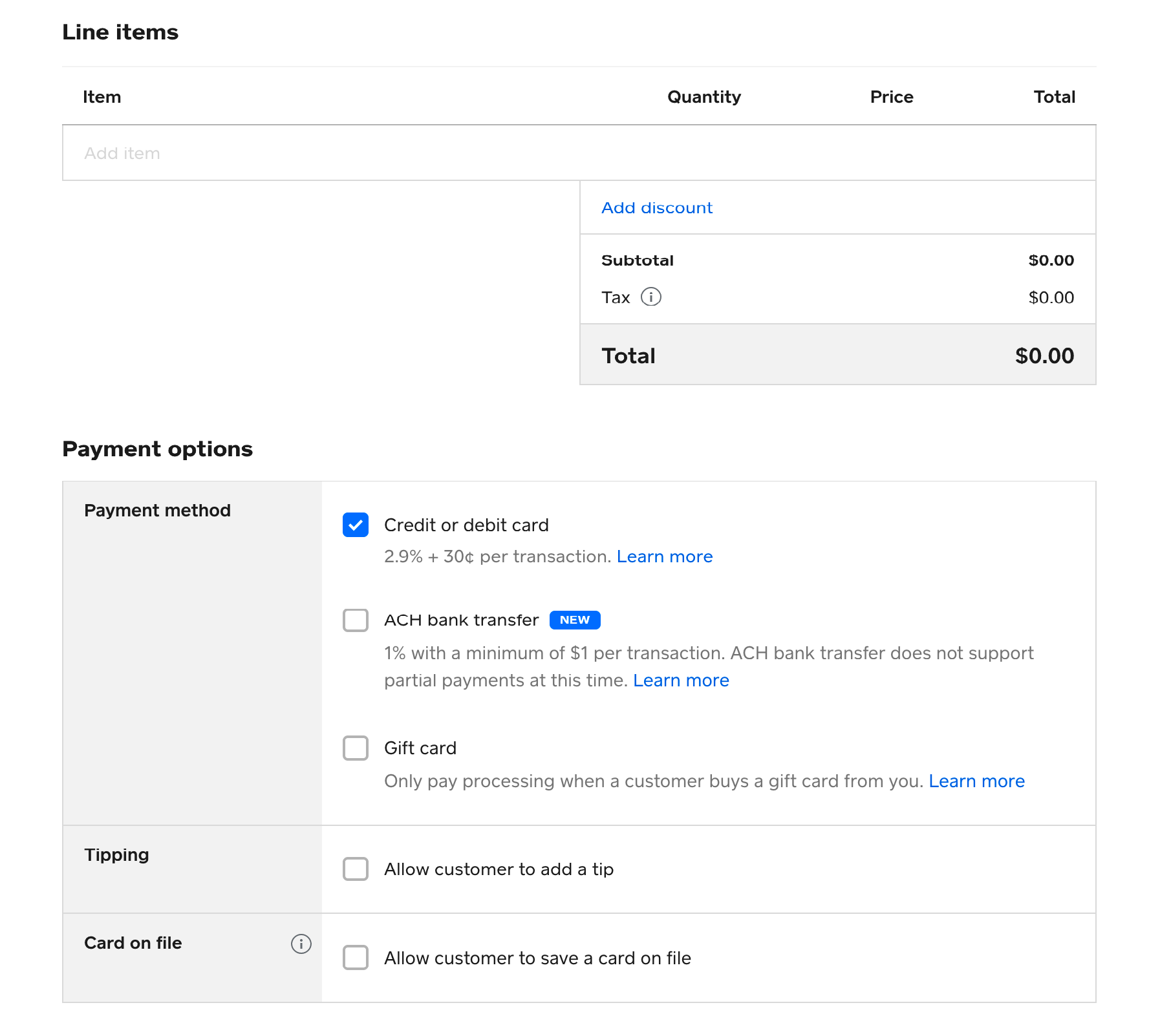

Once you sign up for Square, you will receive instant access to the sales, order, inventory, and customer management tools which can be accessed via the free POS. Custom lower pricing for merchants with yearly revenues higher than $250,000 and with an average ticket size of more than $15Įach customer is entitled to a free POS system per account for Square Payments.A chargeback protection fee for sellers which covers disputes amounting up to $250 per month.An option for instant deposits with an added fee of 1% of the sum processed.Deposits are made to your bank account within 1-2 days of the payment.Universal rates for processing of the different card types (credit, debit, corporate, prepaid, or rewards).The ability to accept all credit cards, including American Express, MasterCard, Visa, Discover, and contactless payments.A nifty Square dashboard that you can use as a hub to track the payments, sales, and other data from your mobile phone.No monthly fee for accepting or processing credit cards of all types.But whichever payment method you choose to apply for your business, you will be provided access to the following main services and features: Invoice and keyed-in payments – 3.5% + $0.15 per transactionĪs a whole, Square offers some of the top-rated merchant services suitable for small and for medium-sized businesses. Online payments – 2.9% + $0.30 per each transaction Mobile card or in-person payments – 2.6% + $0.10 per each transaction The Processing Fees for Payments with Square

#Square invoice fees plus#

Square also offers additional services, including paid Plus plans and several types of POS terminals and card readers, which are also charged with monthly fees. Keyed-in payments – 3.5% + $0.15 per payment Swipe, tap, or chip transaction fees – 2.6% + $0.10 per transaction (lower prices are charged for paid plans) Keyed-in payments – 3.5% + $0.15 per payment Square Appointments Prices and Fees Keyed-in payments – 3.5% + $0.15 per payment Square for Restaurants prices and fees Swipe, tap, or chip transaction fees – 2.6% + $0.10 per transaction (lower pricing is available for the paid plans) Keyed-in payments – 3.5% + $0.15 per payment Square for Retail Prices and Fees Swipe, tap or chip transaction fees – 2.6% + $0.10 per transactionĮcommerce transactions and invoice payments – 2.9% +$0.30 per payment The company doesn’t charge monthly fees, and all payments are processed with a flat-rate fee deducted.Ĭheck our in-depth review of Squareup A quick overview of the fees and the pricing of Square Square POS Prices and Fees

Any additional subscriptions are charged on a month-by-month basis, and so is the financing for the hardware.

#Square invoice fees software#

The service is provided without a locked-in contract, and there are no termination fees charged for merchants who cancel the service or decide to return the hardware provided.Īll of the basic software offered by Square is free.

The service is available to all merchants and businesses with no requirements for proving a business history and minimal other requirements. The pricing of Square is straightforward and transparent. Most importantly, Square has predictable fees, a transparent rate and fee system, and no hidden fees. It can be customized to fit different business types and sizes. Merchants consider Square as an affordable alternative to other paid POS and payment tools and systems. The reason is mainly because of its ease of use, its flat-rate transaction fees, its lack of monthly fees or chargeback fees, the free or affordable hardware provided, the impressive mobile app, and the additional business services for multiple channel sales, inventory, marketing, payroll, customer feedback, and other business management. Square has become very popular since it was first introduced in 2009 under the name Squareup. Square is a POS, card processing, payment system, and an ecommerce and business management tool for small, medium-sized, and large businesses.

0 kommentar(er)

0 kommentar(er)